Our basic review will provide critically important information for you to be able to determine if your policy:

- will last to life expectancy at current premium rates

- is performing according to original projections

- if the projection assumptions were reasonable

- if your policy provides all the potential coverage you need including a long term care component

- is in jeopardy because of loans against the policy which can result in adverse tax consequences

- has what we call “floor guarantees” if your policy has an investment component

All of the above and many more issues can surface from our review.

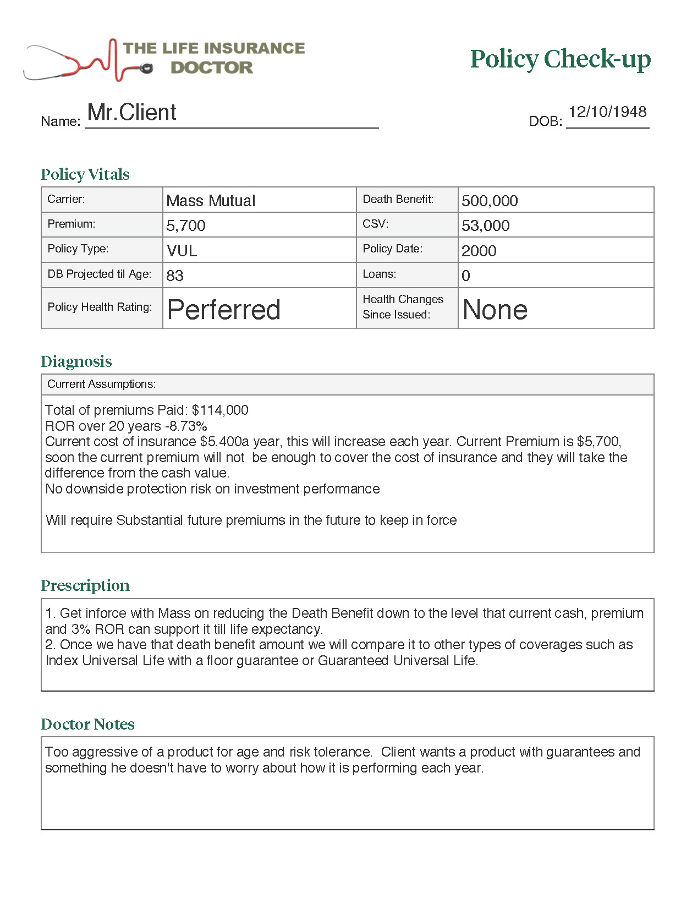

Below is an example of a review we did that saved the client considerable money and protected his policy from lapsing:

Our mission is to help protect and Maximize the value for policy owners…allow us to help you in that process

A proper review cannot be done except by an expert life insurance advisor and consultant.

Everything begins with an expert life insurance performance review.

In order to accomplish this properly, it is necessary to start with what we call current in-force illustrations of your policy.

An in-force illustration is the only way to gauge the potential future performance of a policy and to see if changes are needed in order to avoid problems.

An in-force illustration uses current policy values (cash value, death benefit, and loan balance) and projects future values based on:

- Current earnings (interest rate/dividend that helps grow your cash value)

- Mortality (the actual cost of the life insurance for you)

- Expense charge (the insurer’s fees)