Advanced Tax

Planning Strategies

Most clients dislike Uncle Sam as their partner…no one wants to pay taxes if it can be avoided….philanthropy is a great way!

My dedication to increasing philanthropy through life insurance as a strategic tool led me to cultivate a robust network of like-minded professionals. Together, we provide clients with comprehensive solutions in income tax planning, charitable and estate planning, and the strategic use of leveraged tools such as life insurance. One of the most frequently overlooked areas in estate tax, charitable planning, and business succession planning are the income tax benefits. Our team focuses on that very important aspect.

![uncle sam [Converted]-01 1](https://lifeinsurancedr.com/wp-content/uploads/2023/07/uncle-sam-Converted-01-1.png)

Meet our

Collaborative Experts

Jerome Hesch

Meltzer, Lippe, Goldstein & Breitstone, LLP

Austin Ash

Ash Brokerage

Case Studies

What to do if you get a spike in income ?

A problem we can help solve.

Example 1:

Problem: Got a call from Emily (51 years old) who was selling a valuable apartment in NYC for $7.6M with a basis of $4M… looking at $1.2M in capital gains tax.

Solution: through the use of a split sale and gift to a charity… client received an income stream for life of $333,000 annually via a charitable gift annuity a tax deduction for gift of $2.6M. completely offsetting the immediate capital gains tax and deferring it for 20 years

Example 2:

Problem: Client called with concerns over $8M in ordinary income earned and $7M in capital gains incurred in 2022.

Solution: Through the use of Charitable Remainder Trust client was able to reduce his capital gains tax due significantly by deferring the reporting and payment of the capital gains tax for his lifetime. For ordinary income tax obligation, we were able to convert the ordinary income tax due on the ordinary income to tax at capital gains rates by placing assets in a CLAT (Charitable Lead Annuity Trust). The income tax deduction in such a trust is equal to the amount donated. This trust is a grantor trust so the donor will be taxed on the sale of his assets, but at capital gains rates. Net result…reduce 40% rate to 20% rate on $8.8M for savings of $1.76M. Happy clients and the remainder beneficiaries of the CLAT get all the increase in the investments over the initial rate tax free. Double win.

Example 3:

Problem: Selling a business without income tax planning

Solution: Joe used a CRT and got the business assets into this lifetime trust before the sale was complete. Joe was able to defer the capital gains tax due on his profit on the sale for lifetime and create a valuable legacy for the charity of his choice.

His family was better off, the charity was better off, and Uncle Sam got less. The additional income stream he received from the CRT facilitated the purchase of life insurance using the tax savings to replace the value of his asset donated for the benefit of his family tax free.

“Over 90% of business owners that sold their business regret not having done income tax planning before selling”

How can a client do

Zero estate tax planning ?

Problem: Larry came to us with the problem. He had an asset which might balloon in value sitting in his Dad’s taxable estate and his dad was 89 years old. Larry wasn’t interested in paying estate taxes, so what could he do to get the value out of the estate before it got much bigger?

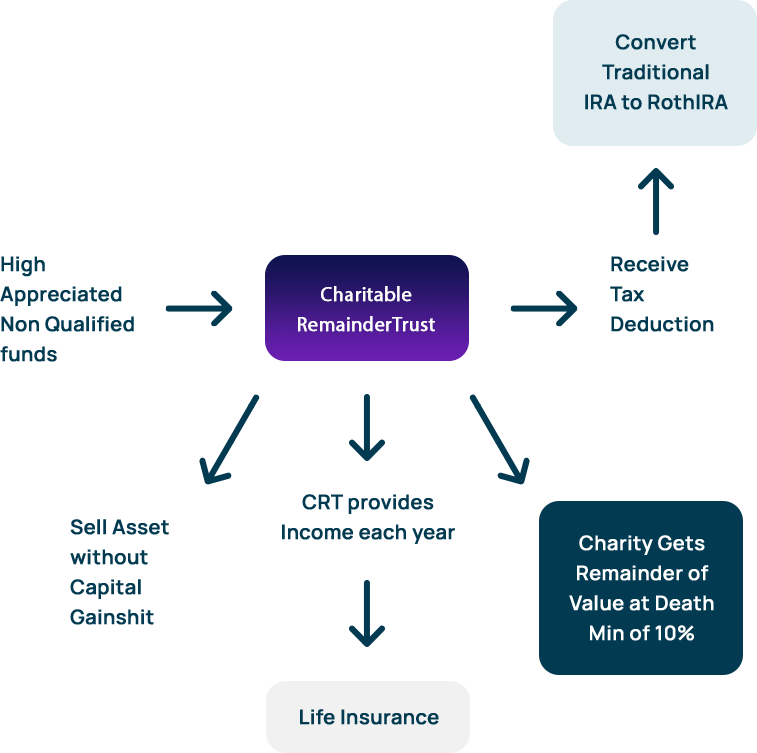

Solution: By utilizing a Charitable Remainder Trust (CRT) the assets were donated promptly and the assets were out of Dad’s estate, thus deferring the capital gains exposure and eliminating the estate tax as the assets were out of the estate immediately. Another option would be to avoid building large wealth in your estate is by funding a new family trust with seed money and if the venture becomes very successful all the growth is out of the estate as the ownership is out of the estate before the growth occurs.

Your Traditional IRA is your most heavily taxed asset both during your lifetime and after you pass away

Convert your IRA to a Roth IRA

Why this is useful?

After the Secure Act IRA’s are no longer a tax efficient asset to leave to non spousal heirs as in most cases the balance must be depleted over 10 years. The owner of the IRA will be taxed during their life on any income taken, the non spousal heirs will be taxed, and the assets are included as part of the estate. The contribution to the CRT removes those dollars from your estate and provides a tax deduction to allow IRA to be converted to Roth IRA which saves future income taxes and creates a tax free asset for heirs. Owning the insurance outside the estate also lowers the taxable estate and passing more to the heirs on a tax free basis.